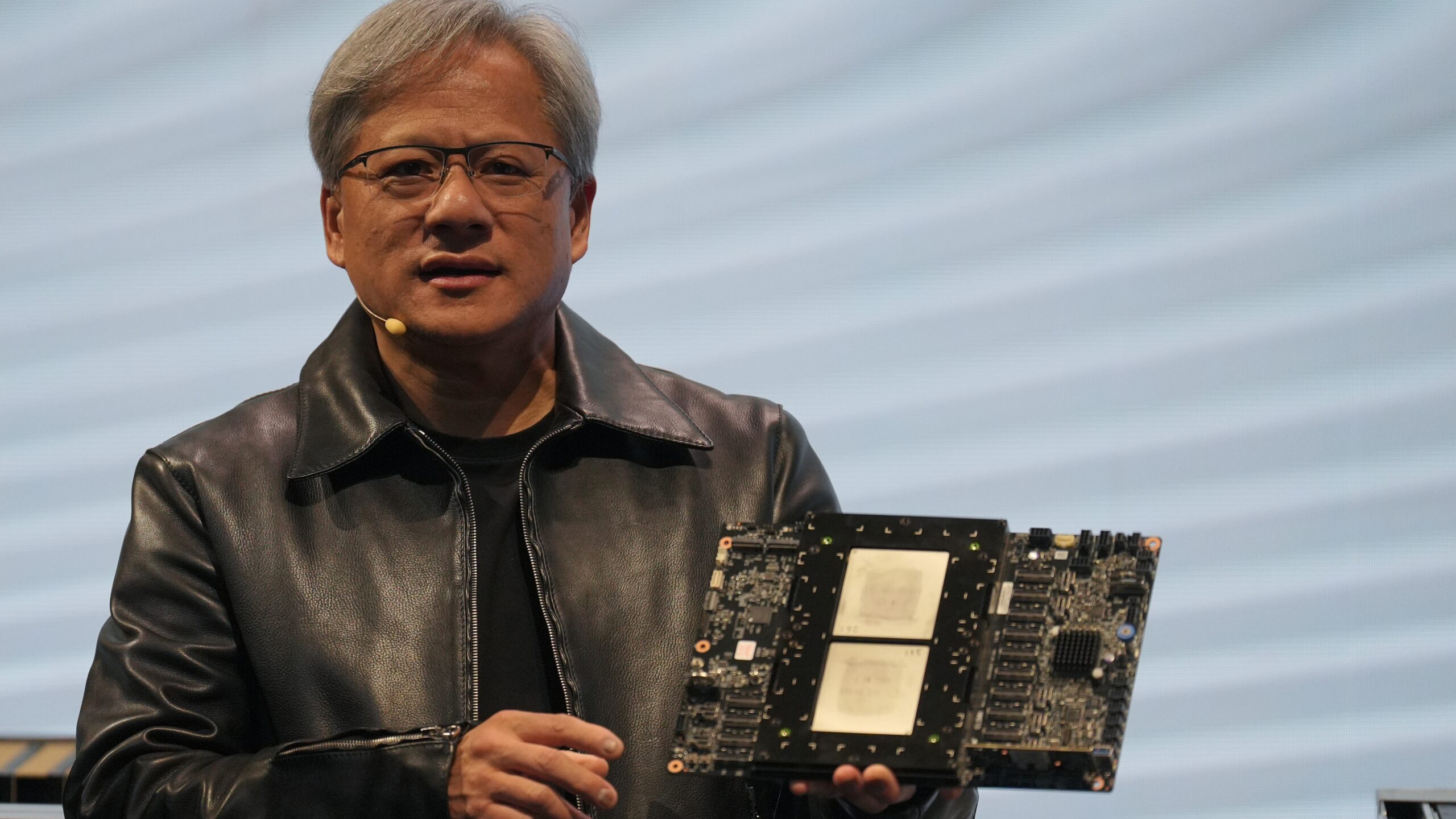

If AI’s good for anything, it’s for allowing tech companies to summit new, Mansa Musa-like heights in their various market caps. Last month, Microsoft rode the AI boom to a $2.9 trillion valuation, pipping Apple to the post as the most valuable corporation on Earth. And now Nvidia’s getting in on the fun, too.

Bloomberg reports that Nvidia briefly overtook Amazon yesterday, hitting a market cap of $1.83 trillion in a rally that saw it briefly become the fourth most valuable company in the world behind Alphabet ($1.84 trillion), Apple ($2.89 trillion), and Microsoft (currently $3.09 trillion).

And while you might think it’s entirely because I finally gave up and forked over an eye-watering amount of money for an RTX 4080, it turns out that, actually, it was because of AI. While other corporations out there are riding the AI wave, it’s mostly Nvidia’s chips that are making it happen. According to a chart from the Financial Times, Nvidia’s estimated revenue from data centre chip spending by the beginning of January 24 totalled about $16 billion, four times higher than Intel’s revenue for the same ($4 billion) and eight times higher than AMD’s ($2 billion).

Even more wild, that’s a level of revenue the company has reached in under a year: Around February/March 2023, Nvidia’s data centre chip revenue was about even with Intel’s at $4 billion. No wonder, then, that the company found itself beating out Bezos in the scrum of yesterday’s markets, albeit briefly.

By the time markets closed, Nvidia was back down in fifth place with a paltry market cap of a mere $1.78 trillion (imagine!), while Amazon was at $1.79 trillion. There’s no reason to imagine Nvidia is going to start falling behind, but it’s hard to make predictions about whether it can keep its momentum up.

Saxo Bank’s Peter Garnry (quoted by Bloomberg) attributed Nvidia’s rise to “riding the investment wave of the current AI boom with massive capital expenditures being deployed in data centres.” With companies like Microsoft and, well, Amazon rushing to make chips of their own, who’s to say how long Nvidia will enjoy its current privileged position?