When Intel announced the return of Pat Gelsinger as CEO back in 2021, it was to pretty universal acclaim. But now he’s gone and it feels like all hope is in tatters. So, what does it all mean for Intel? If Intel’s arch rival AMD is any guide, you can kiss goodbye to Intel’s fabs.

Hold that thought. Gelsinger’s return in 2021 seemed like a hugely positive development and that arguably came down to two things. First, he was an engineer and not a money man. Second he was a great communicator.

For what felt like the better part of a decade, Gelsinger’s keynote was the unambiguous highlight at the annual Intel Developer Forum techfest in San Francisco. He was passionate, engaging, convincing. To hear Gelsinger speak was to believe the future of tech was bright and that Intel would be driving it.

But now Gelsinger is toast and it’s not hard to understand why. As things stand right now, Intel has very little that’s truly tangible to show for the Gelsinger era, at least from an outside perspective.

The company’s financials have been getting worse and worse, with its most recent results returning the largest loss in Intel’s history. Meanwhile, it’s losing market share to AMD in its core CPU segments and it doesn’t even seem to be able to get the basics right after a huge debacle involving crashing and instability problems with its bread and butter desktop CPU products and delays launching key server chips.

The final ignominy in all this was Intel being replaced by Nvidia in the totemic Dow Jones Industrial stock index. Yes, there has been the odd ray of light. The new Lunar Lake laptop chip is pretty good, for instance. But it apparently doesn’t make Intel much money thanks to being mostly made by TSMC and using on-package RAM. So Gelsinger has said Intel wouldn’t do it that way again.

At the heart of all this is are Intel’s problematic fabs, the industrial units where chips are actually manufactured. The harsh reality is that those fabs have, to a greater or lesser extent, been dysfunctional for a better part of a decade.

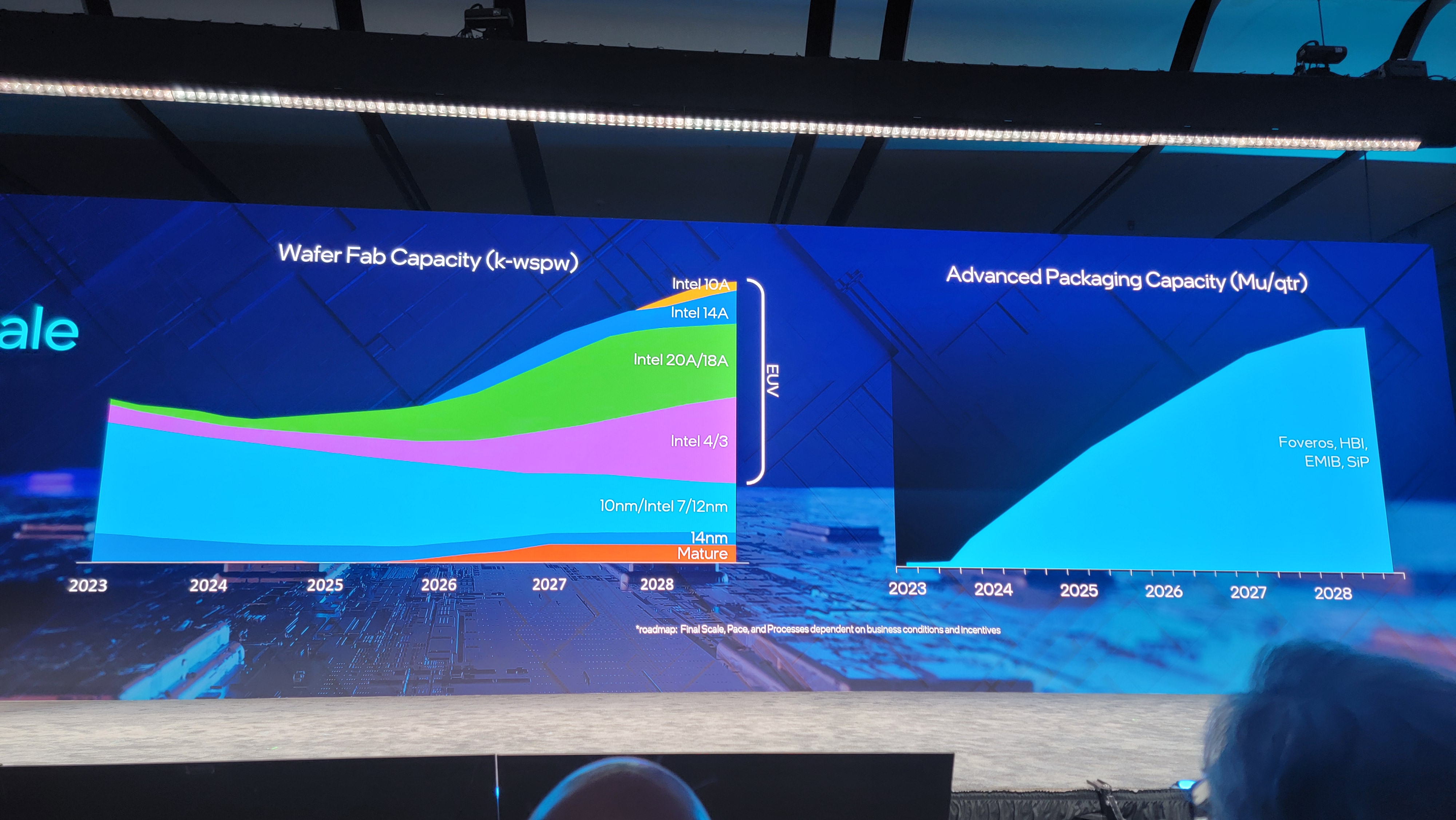

More importantly, there’s limited hard evidence that the problem has been fixed. Gelsinger’s plan involved what he claimed would be five new silicon production nodes in four years.

However, the reality was that the plan only involved two truly new nodes, of which only one has entered limited production in chips you can actually buy and Intel increasingly relies on TSMC to manufacture its products which says all you need to know about what Intel thinks about its own fabs.

Indeed, by Intel’s own estimations, we’re still three years away from the bulk of its production capacity being represented by those new nodes and that’s presumably a best case scenario. So, the big question is where Intel goes from here.

Under Gelsinger, the plan was ultimately two-fold. First, return Intel to technology leadership when it comes to manufacturing chips, investing around $100 billion into its fabs in the process. Second, use that leadership to expand into contract manufacturing for customers and therefore take on Taiwanese uber-fab TSMC head on.

As Gelsinger departs, neither of those objectives have really been partially, let alone unambiguously, achieved. Intel remains at least a node behind TSMC and it’s yet to be proven that major players in the chip business are ready to give their business to Intel.

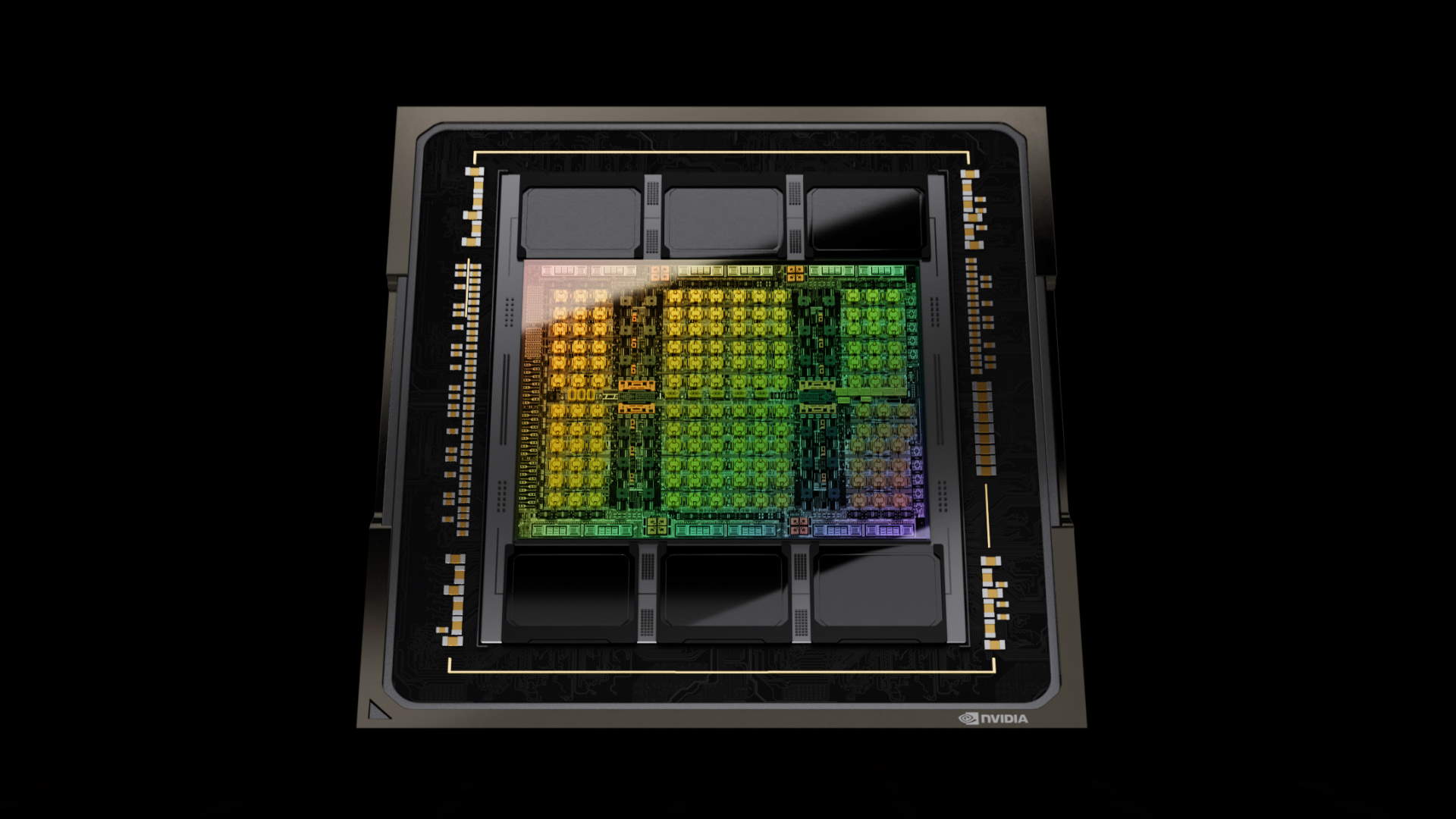

All the while, and perhaps most shockingly, Intel has conspired to almost entirely sidestep the most lucrative new trend in the computing industry, namely AI training and inferencing using GPUs. Intel barely has a foothold in that market and Gelsinger has essentially dismissed Nvidia’s multi-billion dollar profits making AI chips as a fluke.

Not good is it? The counterpoint to all this is that Intel still dominates the market for traditional PC processors and server CPUs, a market that isn’t going anywhere and unlike AI GPUs isn’t at any risk of suddenly falling out of fashion.

What’s more, there is actually a handy case study Intel can turn to, namely its arch rival AMD. If anything, AMD was in an even more parlous state than Intel is now and has managed to entirely turn its business around.

Notably, AMD did that by spinning off its own troublesome fabs and focusing on simplifying and rationalizing its product range. Internally, Intel has already separated its fabs into a standalone business unit.

Most recently, Intel announced various measures to scale back aspects of its massive investment into fabs including “pausing” plans to spend $30 billion on a fab in Germany, a supposedly temporary development that many observers suspect will become permanent.

So, a widespread assumption is that with Gelsinger’s departure, the demise of his Intel Foundry dream is inevitable. The fabs will be sold off, maybe even pseudo-nationalised if the US government sees them as sufficiently important in strategic terms.

Indeed, chip fabs are generally seen as so important that the usual concerns over anti-trust may not apply. So, any number of mergers that normally wouldn’t seem like a goer could be possible.

For sure, the product side of Intel’s business looks healthy and could be making good money as a fabless operation farming all its production out to TSMC.

The problem is that the fab side of the business is losing $5 billion and upwards a quarter and isn’t worth anything right now. The fabs’ only substantial customer is Intel itself and the critical 18A process that will supposedly put Intel back in something approaching a leadership position isn’t due to go into volume manufacturing until late 2026. And that’s obviously a best case scenario.

Meanwhile, the list of companies with the technical prowess and financial resources to take on Intel’s fabs in any kind of acquisition is extremely short and probably only contains a single name. Long story short, there is no easy way out of this, which is why Gelsinger fell on his sword. If it was easy, he’d have fixed it.

The future for Intel is therefore very hard to predict. My best guess is that the company probably will be split in two and that the future of what is now Intel Foundry will likely depend on government intervention.

Should the US government view Intel’s fabs as strategically critical, it may seek something along the lines of a partnership with TSMC that sees the latter take over the burden of running those facilities in return for a life raft for its own operations should tension with mainland conflict spill over.

That could ensure the US retains cutting-edge domestic chip manufacturing technology. Otherwise, Intel’s fabs may go the way of AMD’s, becoming producers of legacy nodes for cheap, bulk chips with no aspirations to compete at the bleeding edge.

Anyway, all we can say with any confidence is that Gelsinger’s departure signals that Intel’s current plan isn’t working. Exactly what the future holds is impossible to say. But the simultaneously sad but reassuring truth is that it probably doesn’t matter for the PC. What with AMD’s success and the increasing incursion of ARM CPUs into the PC platform, Intel’s ability to dictate what happens to the platform is almost certainly in terminal decline, whatever happens to the business itself.

Best gaming PC: The top pre-built machines.

Best gaming laptop: Great devices for mobile gaming.