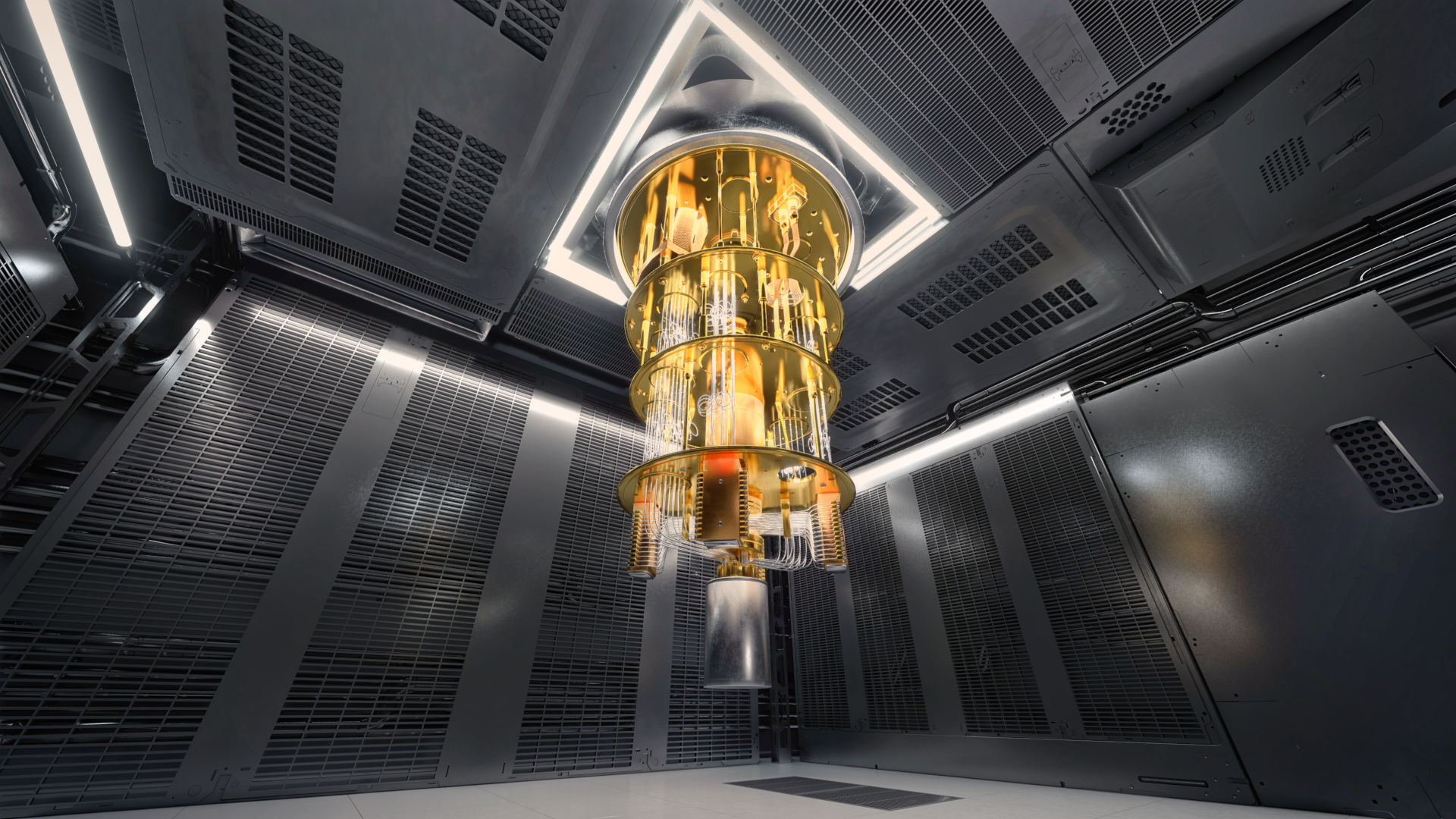

Remember when a computer meant something that used traditional, familiar algorithms? Ah, simple times. Now we not only have machine learning—aka, supposed “artificial intelligence”—but also quantum computing, which uses microwaves to get qubits to do wacky and seemingly impossible things. Regarding the latter kinds of computers, though, Nvidia CEO Jen-Hsun Huang reckons we’re quite far from seeing actually useful ones.

That’s straight from the horse’s mouth, so to speak, which you can witness for yourself by skipping to 40:00 in the video of the CEO’s recent investor Q&A (via The Register) held at CES 2025.

In response to a question about quantum computing, Huang says: “We’re probably somewhere between—in terms of the number of qubits—five orders of magnitude or six orders of magnitude away, and so if you kind of said ’15 years’ for very useful quantum computers, that would probably be on the early side. 30 is probably on the late side. But if you picked 20, I think a whole bunch of us would believe it.”

The unfortunate side effect of Huang’s words, as reported by Reuters, is that many quantum computing companies have seen their stocks drop. Reuters explains that “Rigetti Computing, D-Wave Quantum, Quantum Computing, and IonQ all fell more than 40%” and “the companies, in total, were set to lose more than $8 billion in market value.”

Stocks for quantum computing companies had only recently shot up after Google introduced Willow, which it claimed “performed a standard benchmark computation in under five minutes that would take one of today’s fastest supercomputers 10 septillion years—a number that vastly exceeds the age of the Universe.”

Huang’s not wrong, though. Practically useful quantum computers—at least “useful” in the way people usually mean—really are a long way off. To think that’s a mark against them, however, is to misunderstand what quantum computing is and what its purpose is.

One big thing that quantum computing investors who have now upped ship might have overlooked is, as analyst Richard Shannon says (via Reuters), there should be “considerable government-related revenues in the next few years.” Investors might, therefore, be “missing a key part of the equation.”

This is because quantum computers are very good at doing niche calculations with low data. Huang himself explains: “Quantum computing can’t solve every problem. It’s good at small data, big combinatorial computing problems. It’s not good at large data problems, it’s good at small data problems.”

One such kind of problem is encryption/decryption, which makes quantum computing something governments and defence industries are very interested in. It’s arguably more of an “arms race” contender than AI is, given the sheer potential compute power for these niche applications compared to traditional computing.

AI and quantum aren’t at odds with each other, either. As Huang also explains in the Q&A, “It turns out that you need a classical computer to do error correction with the quantum computer. And that classical computer better be the fastest computer that humanity can build, and that happens to be us.” In fact, Huang says, “We want to help the industry get there as fast as possible and to create the computer of the future.”

Somehow I don’t think Huang’s “20 years” claim is going to stop the march of progress on the quantum computing front, regardless of any stock slides.