Earlier today, Matthew Ball, CEO of investment strategy firm Epyllion, released an early version of a presentation called “The State of Video Gaming in 2025.” The slideshow, which incorporates data from market research firms like IDG, Newzoo, and Circana, summarizes worldwide market trends in the gaming industry. I’ll be honest: Things aren’t great. Following a decade-long growth wave between 2011 and 2021, the industry’s revenue growth has stalled, feeding into an atmosphere of risk aversion and stagnating investment.

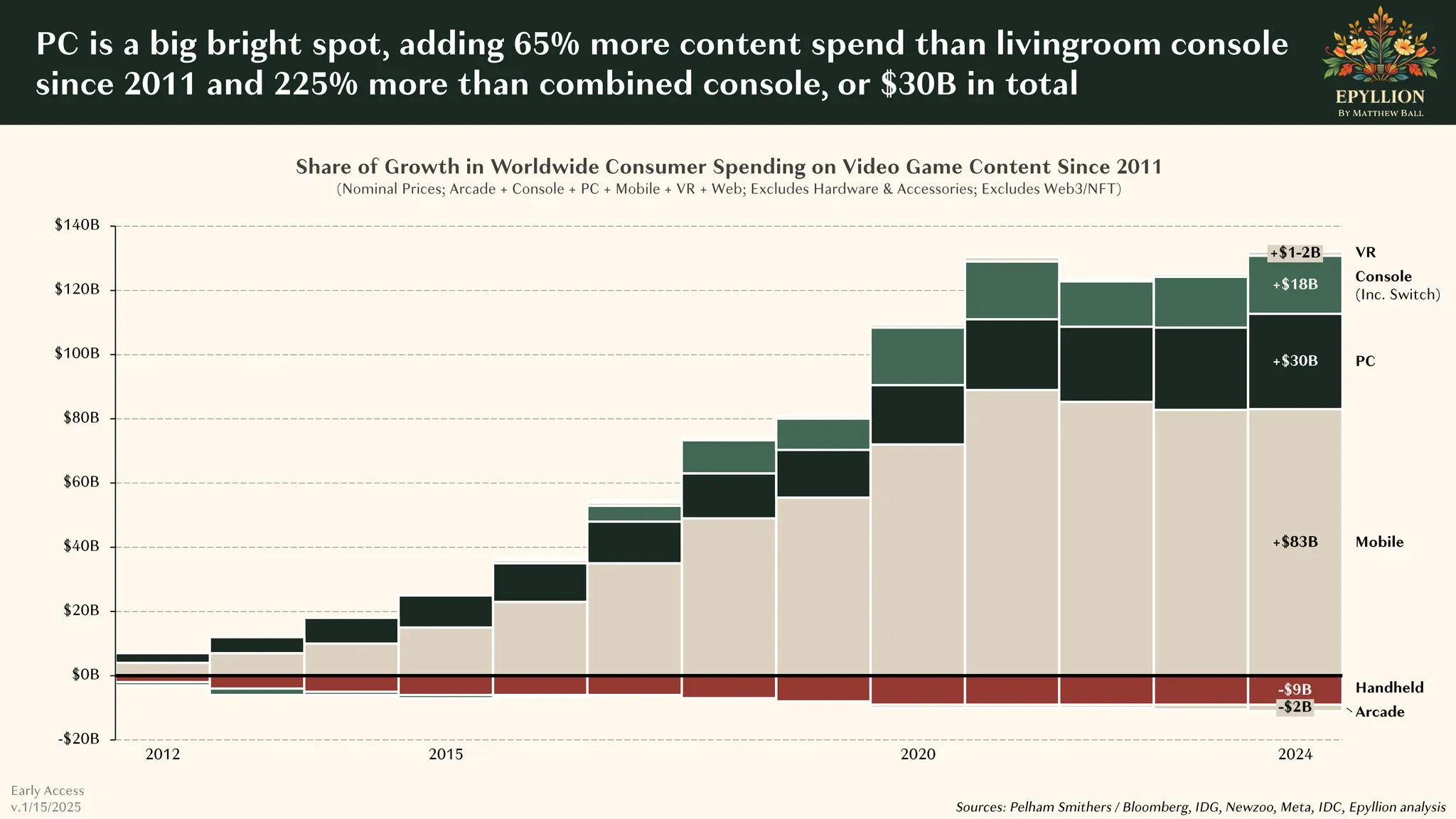

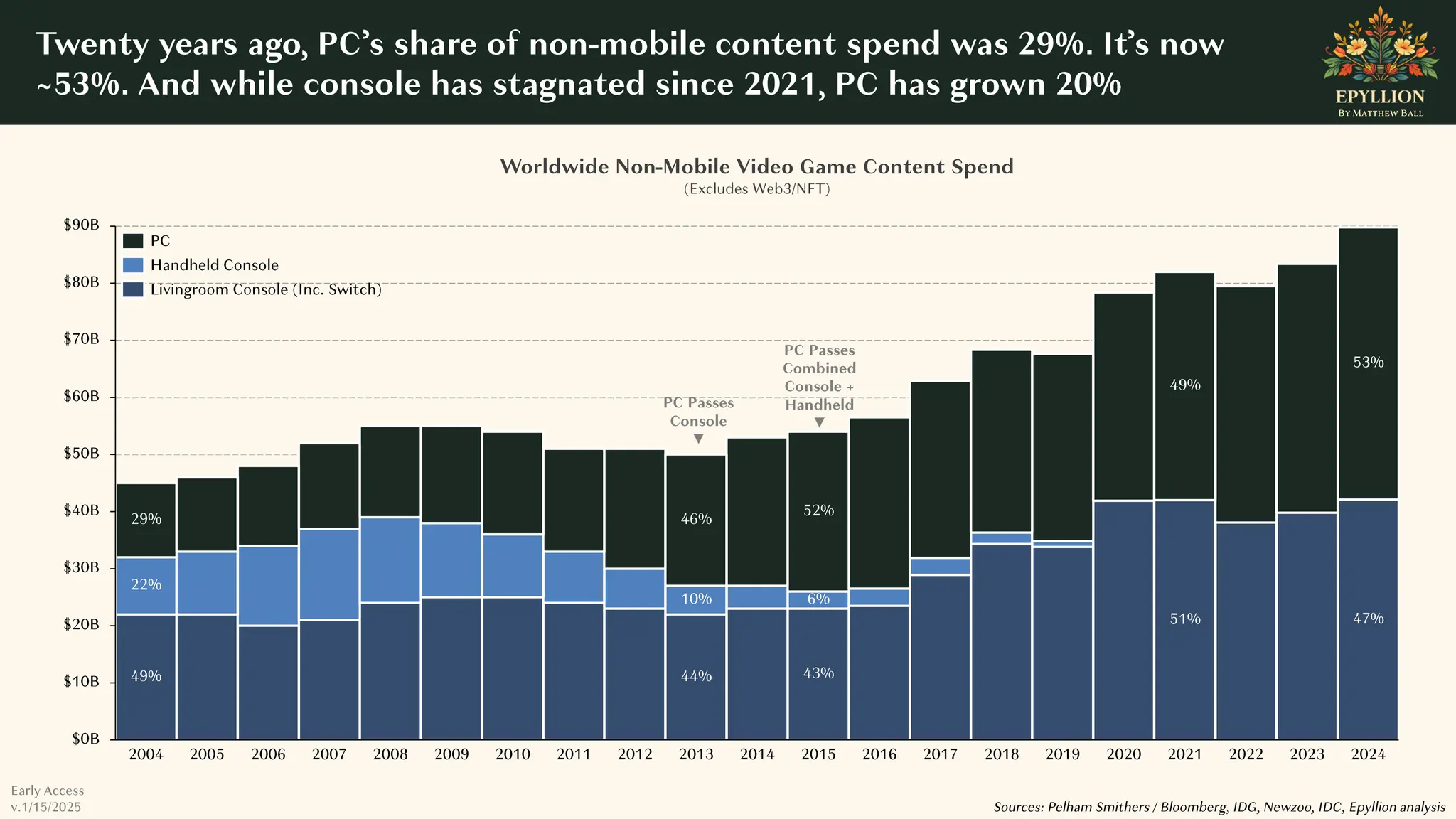

The outlook isn’t entirely dire, however. While gaming industry revenue growth has plateaued over the last three years, Epyllion’s analysis says PC gaming is “a bright spot” of continued growth, now accounting for the majority of non-mobile content revenue.

According to Epyllion, both PC and console gaming are—as you may have noticed—considerably bigger concerns than they were at the turn of the 2010s. In 2024, consumers were spending almost $50 billion more on PC and console games than they were in 2011.

But beginning in 2021, console gaming growth started to slow, which is particularly clear in worldwide Xbox Series S/X and PlayStation 5 console sales. Compared to the previous console generation, the current Microsoft and Sony console lines had, after 49 months, sold nearly 7 million fewer systems.

PC gaming, meanwhile, has only continued to grow. “While console has stagnated since 2021,” Epyllion says, PC gaming revenue “has grown 20%.”

Epyllion attributes PC gaming’s continued growth to “many compounding advantages over the console ecosystem,” like a more extensive release library with greater backwards compatibility, more immediate access to web browsers, social platforms, and livestream software suites, and higher top-end performance.

What’s more, Epyllion says PC gaming’s “momentum is still growing,” thanks to cross-releases of console exclusives, advancements in portable PC gaming devices like SteamOS, and, well, Roblox. “Hundreds of millions of children growing up on Roblox are unlikely to ask for a $500 console to play AAA games,” Epyllion says.

As promising as Epyllion’s outlook is for PC gaming, it’s worth noting that there isn’t a universal consensus on who’s got a bigger market share between consoles and PC. For example, in August 2023, Newzoo reported that console games had attracted $56.1 billion in consumer spending compared to around $40 billion for PC games. For an explanation of what might account for the discrepancy, we reached out to Matthew Ball for comment.

“IDG is typically considered the source of record for sales tracking in the industry, which is why I primarily deferred to their estimate,” Ball told PC Gamer via email. “If you look at Pelham Smithers, a private research agency/bank in the UK, which is what Financial Times usually uses, and what Bloomberg uses (and actually puts through the Bloomberg Terminal), they actually have PC as 50% larger than console. IDC is relatively close to IDG, but not identical.”

Ultimately, Ball said, “there is some disagreement.” Ball’s theory is that market researchers might vary in their tracking of game sales in China—which, he says, are “mostly PC at the AA/AAA level.” In Epyllion’s analysis, Ball said he “deferred to where publishers told me I should here, and then cross-referenced with a few other sources such as IDC and Bloomberg.”

As for PC gaming’s future, Ball said he’s confident in Epyllion’s outlining of the PC gaming market’s “still intensifying” growth advantages. “I believe that deeply,” Ball said, “especially if/as Steam extends to living room and handheld.”