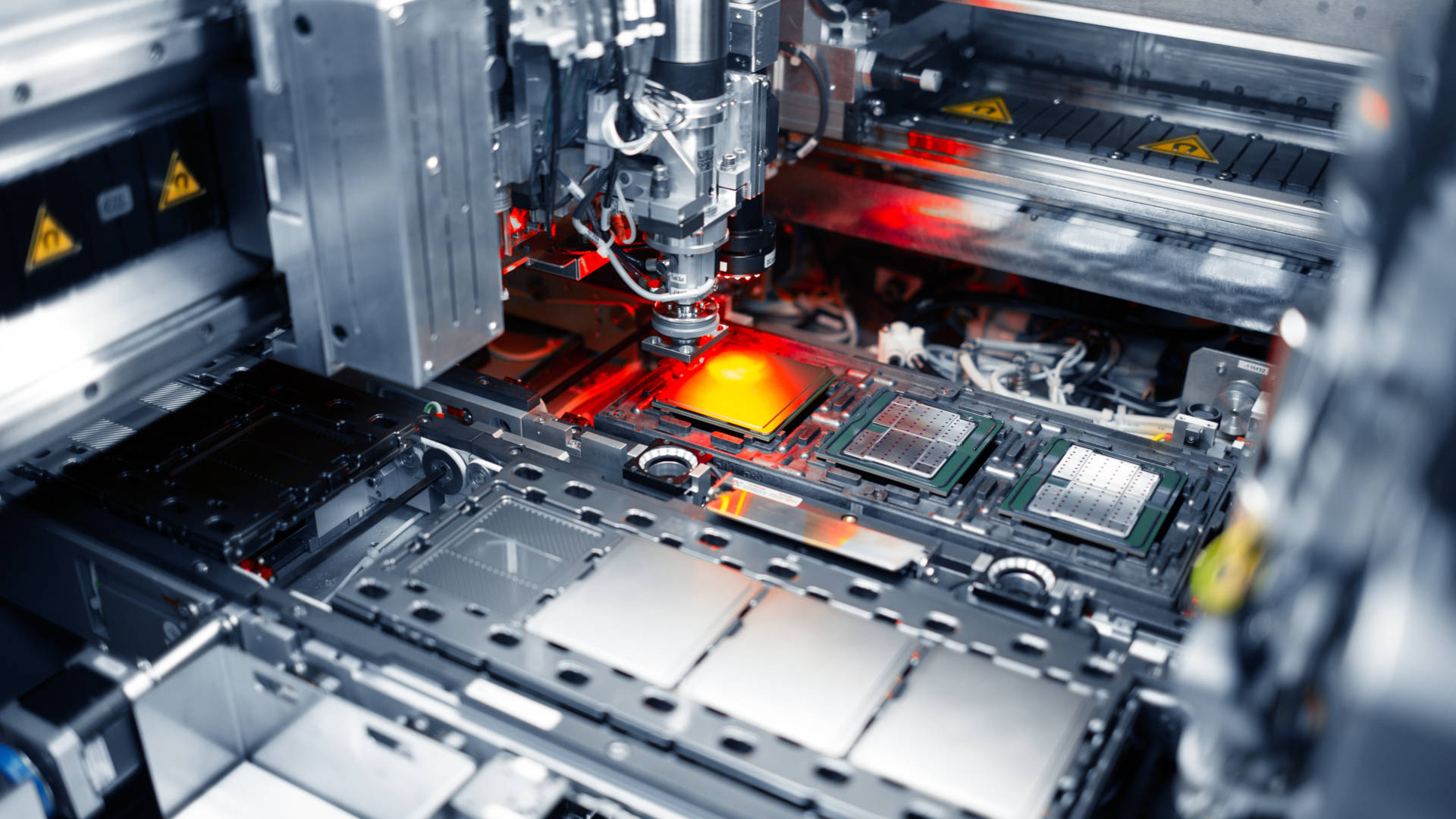

Love it or hate it, if President Trump’s tariff-heavy threats have done one thing it’s show the world that the US is serious about its chip industry. And if one company is synonymous with the US chip industry, it’s Intel. But there are some tides that might be too strong to turn despite a new US administration, and it seems at least some are worried that this might describe Intel.

After plenty of back-and-forth speculation about the possibility of various companies buying up parts of Intel, ex-AMD engineer and current Tenstorrent CEO Jim Keller has thrown his hat into the ring of opinion. Responding to an X post saying the Intel board “reportedly wants to sell off the company to unlock (likely one-time) shareholder value”, Keller argues that “this is not unlocking shareholder value, it’s a fire sale.”

you build value by having a great goal and a team that loves working to the goal.Intel built the fastest cpus on the best process.this is not unlocking shareholder value, it’s a fire salehttps://t.co/ele5GXyLudit makes me sadFebruary 18, 2025

“It makes me sad,” Keller says, in a tone reminiscent of Bill Gates’s recent lamentation over Intel’s (and specifically Pat Gelsinger’s) apparent failure to turn the company around. Rather than splitting up and selling off the company, the ex-AMD chip boffin has a more traditional value-building strategy in mind: “You build value by having a great goal and a team that loves working to the goal. Intel built the fastest CPUs on the best process.”

Further driving the point home, he posts again, saying: “I think a great Intel is worth $1 trillion. Seems a little careless to throw it away.” The implication being, to me at least, let’s make Intel great again.

We can probably assume that’s what the Trump administration will be thinking, too—add a MIGA to its MAGA, why not? A strong Intel means a strong US chip industry, and the alternative is selling off an Intel chipmaker to foreign companies, presumably tariffing the resultant chips into oblivion.

The talk on the ground hasn’t been settled of late—people can’t seem to decide which company or companies would likely buy Intel’s chip design and/or fabrication divisions. Conflicting reports had it that TSMC both was and also wasn’t supposed to be in talks to buy Intel’s fabs. And there’s been talk of Broadcam acquiring the design side if another company such as TSMC took the fabs.

A Broadcom sale would keep at least some of Intel in the hands of the US (well, a US-based company, at least), and this possibility is in fact what Keller was responding to. One of X posts he replied to asks: “Couldn’t Intel’s chip join the well run Broadcom family, Altera and Mobileye live their lives and Intel foundries become a national asset we protect and turn around?”

Broadcom taking Intel Chip and Intel foundries becoming a “national asset” would certainly keep things in the US, but would it make for a great Intel? Could we trust the state to succeed in making Intel great again?

If Keller’s correct and a good Intel can make for a $1 trillion chipmaking company, then maybe it would be a little careless to throw it away. Much of this will surely ride on whether the company’s 18A node is up to snuff, and if Gelsinger’s departure is anything to go by, I’m not filled with confidence.

Whatever the case, we’ll just have to see what the board decides to do and whether the US government decides to step in. Strange times, indeed.

Best CPU for gaming: Top chips from Intel and AMD.

Best gaming motherboard: The right boards.

Best graphics card: Your perfect pixel-pusher awaits.

Best SSD for gaming: Get into the game first.