Yesterday, Valve published its yearly “Steam Year In Review” blog post, a retrospective highlighting Steam feature additions and customer data trends from 2024. Calling 2024 “a year of growth,” Valve said Steam’s number of peak concurrent users is nearly twice what it was in March 2020—and last year, all those users were playing more new games than ever.

“2024 was the Steam platform’s best year ever in terms of customers buying newly released games,” Valve said. In 2024, new release revenue on Steam, which Valve defines as sales revenue from the first 30 days after a product’s release and any pre-purchases, was ten times higher than it was in 2014. More than 500 games earned more than $250,000 in new release sales, with more than 200 of those earning more than $1 million—an increase of 27% and 15% from 2023’s numbers, respectively.

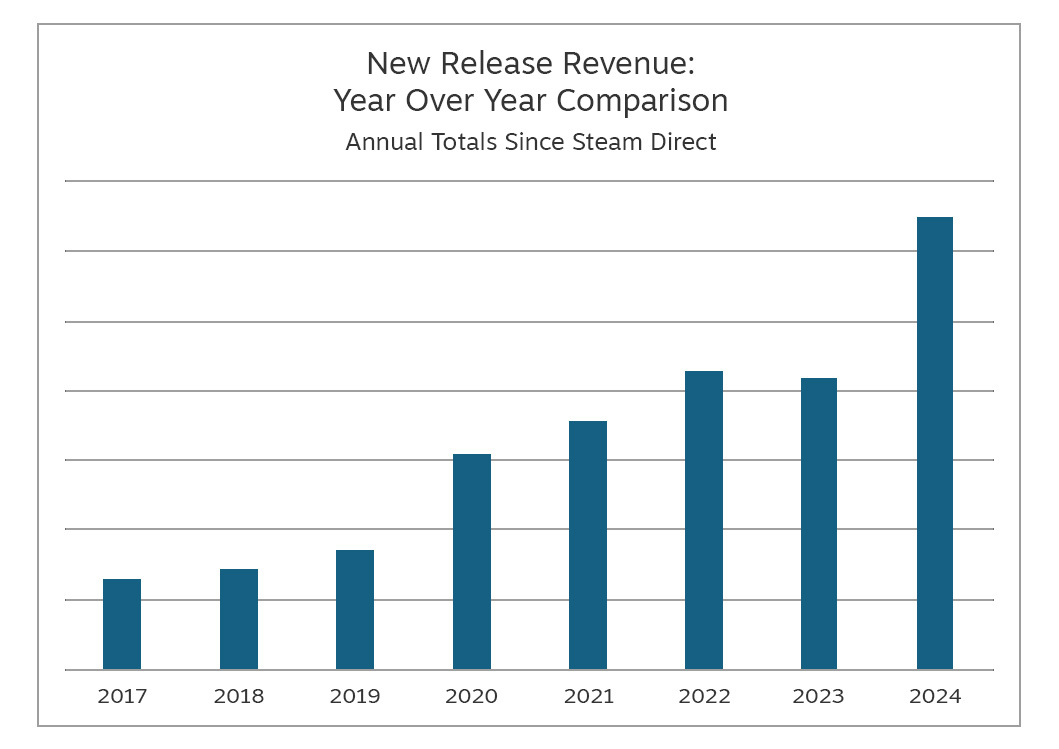

Valve also provided a chart (see above) showing steady increases in yearly new release revenues since 2017.

What the chart doesn’t include, however, is any labeling to indicate what those revenue figures actually were. And without any figures or bars indicating sales revenue from games outside their new release window, it’s an incomplete picture. If live service game revenues increased by even larger percentages, for example, those greater new release sales would’ve actually accounted for a decreasing portion of Steam’s revenue.

Valve does publish a yearly list of Steam’s biggest earners, and 2024’s highest tier contains a number of new games that we know were hits: Palworld, Helldivers 2, Space Marine 2, Black Myth Wukong. But the usual suspects are there, too: Dota 2, Counter-Strike 2, Apex Legends, PUBG. And although it is technically a new release, Call of Duty: Black Ops 6 hardly feels like one given we’ve gotten a new CoD every year for the past 20 years, and they’re now all bundled into one Call of Duty launcher.

Still, the trend of increasing new release revenue provides some additional context for the chilling reveal during last year’s Steam Replay that only 15% of user play time was spent in games released in 2024. As dire as that number might seem, it’s actually up from 2023, where only 9% of play time was spent in games released that year. (It’s down from 17% in 2022, though.)

It’s tempting to read the trend as proof of the games industry vibe shift we prophesied at the end of last year, where the continuing string of live service closures—like the recently announced Spectre Divide shuttering—brings an end to the doomed pursuit of the next forever game. But many of the new games in the 2024 Steam best sellers list, like Throne and Liberty, The First Descendant, and Once Human, are still chasing that same goal. By Valve’s definition, their first 30 days of microtransaction sales would count as new release revenue.

Without a more holistic dataset, we can’t say whether rising new release revenue indicates a coming sea change or if the water’s moving with the same tides.